Today we’re going to look at what’s been going on this past year in the chip shortage, particularly in the automotive markets. I’m going to share some recent events and statements that may shed some light on what’s been happening.

In Part Three we went through a deep dive on some aspects of Moore’s Law, the semiconductor foundries, and semiconductor economics, and we looked at the game Supply Chain Idle. We touched on a couple of important points about the economics of foundries:

- Fully-depreciated equipment has been producing chips for mature technology nodes fairly steadily, even though these now make up a small portion of revenue

- Smaller ICs like microcontrollers (MCUs) are still being produced on mature nodes, because they’re not economical to design and manufacture on more advanced nodes

- The prices to make ICs on these mature nodes are low, because they’re fully depreciated, but this poses a dilemma: now that prices are so low, there’s no economic impetus to add more capacity

For Part Four I wanted to take a breather from IC manufacturing economics to look at where things are today, since I published Part One at the very end of 2021.

Hint: it’s not exactly unicorns and roses.

Let’s get those disclaimers out of the way early, so we can get this over with.

Disclaimers

I am not an economist. I am also not directly involved in the semiconductor manufacturing process. So take my “wisdom” with a grain of salt. I have made reasonable attempts to understand some of the nuances of the semiconductor industry that are relevant to the chip shortage, but I expect that understanding is imperfect. At any rate, I would appreciate any feedback to correct errors in this series of articles.

Though I work for Microchip Technology, Inc. as an application engineer, the views and opinions expressed in this article are my own and are not representative of my employer. Furthermore, although from time to time I do have some exposure to internal financial and operations details of a semiconductor manufacturer, that exposure is minimal and outside my normal job responsibilities, and I have taken great care in this article not to reveal what little proprietary business information I do know. Any specific financial or strategic information I mention about Microchip in these articles is specifically cited from public financial statements or press releases.

Furthermore, nothing in this article should be construed as investment advice.

Oh, and there’s no game to play along with in this article. If you really want one, try Industry Idle — somewhere in there is a lesson about supply chains and inventory and transportation, but it doesn’t seem as enlightening as the others.

Que Sera, Sera / Storm Clouds Cantata

As I write this, it’s in the thick of the third-quarter earnings season. I have mixed messages to share, on three issues.

You’ll Take the High Road and I’ll Take the Low Road

One is that the chip shortage situation as of late 2022 has changed. I said in Part One that the chip shortage was not a monolithic phenomenon, that there was actually a group of shortages happening in different market segments. And they’ve now diverged. The leading-edge shortage is essentially over; the trailing-edge shortage continues. Executive board chairman Steve Sanghi gave a concise summary during Microchip’s November 3 2022 earnings call:

So it began a year and a half ago, with capacity being constrained at all the nodes: trailing-edge, leading-edge, and the middle of the way. What has happened in the last few quarters is with the personal computers and cell phones, which are significant consumers of semiconductor, and mostly semiconductors on the bleeding edge of technology: you know, processors and very high-end chips in the cellular phone. With the correction in that market, the leading-bleeding-edge capacity now is really no longer constrained. You have seen dramatic downside guidance by a lot of the very leading-edge people. So today, if you wanted a 7-nanometer, 10-nanometer, 14-nanometer capacity, you can have everything you need.

But the trailing-edge capacity continues to be extremely constrained. On trailing-edge, we built some inside, and we also bought some from the foundries, and we are constrained on both. Inside, we haven’t been able to get all the equipment we wanted. Most equipment that was even scheduled to be delivered got pushed out by many months, sometimes many quarters, because the equipment supplier wasn’t able to get semiconductors for their parts. So the inside products that we’ve done inside remain constrained on many different corridors. And the capacity we buy outside is really very similar. The trailing-edge capacity remains constrained, and we currently believe will remain constrained well into 2023.

Willy Shih covered this in a recent article in Forbes[1] with these section titles that pretty much describe the situation:

- The high end is seeing softness — demand for PCs/mobile phones has dropped

- Commodity segments like memory appear to be swimming in inventory — DRAM pricing is falling again

- But the automotive sector continues to struggle — mature nodes are still supply constrained

Shih goes on to say:

One lesson we can learn from this mess is that when you take an aggregated view of the semiconductor sector, combining the high end, commodity, and mature chip sectors, it can mask what is going on in different segments of the market. I find the same problem when combing through government import/export trade data or Bureau of Labor Statistics stuff. There’s always great value in understanding the detail.

A Recap of 2022

The second issue to note is that there have been a number of “interesting” events affecting the semiconductor industry and the general economy this year. Here are some:

- Jan 12 US Consumer Price Index year-over-year increase reaches over 7% for the first time since 1982, reaching a peak of 9.1% in June 2022.

- Jan 21 Intel announces it’s building new fabs in central Ohio, less than four months after breaking ground on its \$20 billion fab expansion (Fab 52 and 62) at Intel’s Ocotillo campus in Arizona.

- Feb 15 Intel announces an acquisition of Tower Semiconductor to play a larger role in the foundry industry

- Feb 24 Russia invades Ukraine; neon supplies at risk

- Mar 17 US Federal Reserve (the “Fed”) raises the target federal funds rate for the first time in two years, by 0.25%.

- May 5 Fed raises target federal funds rate by 0.5%

- May 17 Renesas announces it will reopen its Kofu Factory in Japan as a 300mm fab to produce power semiconductors; the site had been closed since 2014, where it was operating 150mm and 200mm fabs.

- Jun 11 Average US gasoline prices exceed \$5 per gallon for the first time (thankfully, they’ve been dropping since then)

- Jun 16 Fed raises target federal funds rate by 0.75%

- Jul 11 STMicroelectronics and GlobalFoundries announce a new joint venture FD-SOI fab in Crolles, France

- Jul 27 - Aug 8 Qualcomm, Intel, Sony, Nvidia forecast weakening consumer electronics spending

- Jul 28 Fed raises target federal funds rate by 0.75%

- Aug 9 US CHIPS and Science Act signed into law — provides over \$52 billion of funding, much of it for semiconductor manufacturing

- Sep 9 Wolfspeed announces a new silicon carbide fab in North Carolina

- Sep 22 Fed raises target federal funds rate by 0.75%

- Oct 4 Micron announces a new “megafab” in New York State

- Oct 6 AMD preliminary 2022Q3 results disappoint

- Oct 7 US invokes the Foreign Direct Product Rule against Chinese chipmakers to prevent any manufacturer using US-made tools from selling advanced ICs to China, and required export licensing if “U.S. persons” participate in certain support roles in IC production.

- Nov 3 US Federal Reserve increased federal funds rates by 0.75% for the fourth time in six months, to a target of 3.75 - 4.00%, compared to a target of 0.75 - 1.00% in May 2022 and 0 - 0.25% from March 2020 to March 2022.

- Nov 14 Infineon announces a new fab in Dresden, Germany

- Dec 6 TSMC holds an opening ceremony at its new Arizona fab to celebrate the arrival of the first pieces of manufacturing equipment. The Arizona fab is scheduled to start production of N4 silicon in 2024; TSMC also announced that they have started a second fab to produce 3nm silicon in 2026.

- Dec 14 US Federal Reserve increased federal funds rates by 0.5%, and signaled that more increases would come next year. At least they’re down to half-percent-at-a-time now.

(I apologize if this seems US-centric; feel free to send me other relevant worldwide events to the semiconductor industry from 2022 and I will add to this list.)

Long-term Trends

And the third issue is that certain long-term trends are continuing — we covered some of these in Part Three:

-

Moore’s Law keeps pushing forward; TSMC is planning for 1nm fabs and Intel’s not too far behind, claiming they’re ahead of schedule for 20A and 18A (= 2nm and 1.8nm, but as we’ve seen in Part Three, this is just a marketing name)

-

200mm wafer demand has been rising since 2014

-

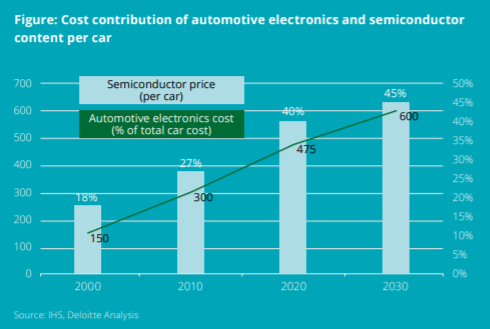

Semiconductor content in vehicles has been rising, in part due to upcoming electrification efforts, and in part due to the performance/cost benefits of electronics.

That’s the short answer.

I’ve got a bit more to say, but I need a shot of soothing wholesome fatalism to keep me going… there’s very little we can do to control what’s going on, so why worry? Que sera, sera....

What does it all mean? Well… 2021 was a year of record earnings growth for many semiconductor companies. Lots of demand. Shortages everywhere. Desperate pleas for more capacity, and many companies announced plans in 2021 and 2022 to build new fabrication plants. But this feeds the semiconductor cycle, as we saw in Part Two. So the big question is, when does the clock strike twelve, when is the ball over, when does the magic carriage turn back into a pumpkin, when does Cinderella’s gown turn back into rags — when do we get our semiconductor glut, that we know is coming?

Doom and Gloom From the Analysts

There are a number of semiconductor analysts out there looking with some caution at the industry’s near future. Here is a sense of what they’ve been saying.

-

Bill McClean of IC Insights pointed to Micron’s June 30 2022 fiscal results as a “canary in a coal mine” with future guidance foreshadowing a decline in the business cycle.

-

Bill Jewell of Semiconductor Intelligence warned of “Semiconductor Growth Moderating” as early as February 2022, with a number of similar forecasts — “Semiconductors Weakening in 2022”, “Electronics is Slowing”, and more recently, “Semiconductor Decline in 2023”. This particular summary included a revenue table of top manufacturers, that caught my eye:

Table © Semiconductor Intelligence, LLC, reproduced with permission.

Note the split of consumer/computational electronics (flat or downhill) and automotive/industrial electronics (growth).

-

Robert Maire of Semiconductor Advisors posted a somewhat whimsical warning called “The Semiconductor Cycle Snowballs Down the Food Chain — Gravitational Cognizance”, comparing the chip cycle to that moment in the cartoons that Wile E. Coyote hangs in the air for a split-second after running off a cliff until he realizes he will fall:

This reminds us very much of where the semiconductor industry is today. The industry has been running so fast and focused on speed that it hasn’t yet realized that the basis that supports the industry has gone away, that is that demand has dropped and will see further declines.

We have been talking about the industry being in a down cycle for months now. Memory prices have dropped (usually one of the first signs) inventories have grown, lead times are down. More importantly, demand for semiconductor rich electronic devices is dropping.

However, some semiconductor and semiconductor equipment companies are still reporting great earnings, record breaking earnings in some cases. This makes it very difficult to talk about a down cycle when you are still making big bucks.

The speed at which the industry has been running has driven so much momentum into the industry that gravitational cognizance has been delayed.

-

Malcolm Penn of FutureHorizons has been predicting a semiconductor downturn for some months now. Penn is one of the veterans in the industry, and an astute observer: he’s seen most of the cycles since the beginning, and in terms of market dynamics, there is nothing new under the sun. Here’s some of what he’s been saying this year:

-

In May 2022, FutureHorizons predicted a bearish 22% decline in the semiconductor industry. The metaphor he uses is a roller coaster at the top of its arc:

-

In an August 2022 article: “Right on cue with our December 2021 forecast, the current semiconductor Super Cycle is finally drawing to a close and the 17th market downturn has now well and truly started.”

-

In a September 13 webinar: (I can’t link directly to this presentation, but here are the highlights on YouTube)

What should be happening in the downturn is that we invest like crazy, ready for the next upturn. But that was not what will happen. What will happen is: investments will be cut back. And will stop, delay, push out plans. And that will unfortunately feed the next upturn, because we will eventually not have the capacity on place when we actually need it. All of the wisdom says invest countercyclically; all of the financial infrastructure tells you: “You cannot do that.” So, you’ve got this dilemma here. Again, it goes back to the onshoring dilemma here, it’s that the structures in the industry are not conducive to actually taming this industry cycle. It’s just in fact the opposite: it’s conducive to fueling the industry cycle. So we will see capex cut back, we will see a dramatic cutback in capex, it will drop right back down again, it will overshoot just as it has done in the past, just as the sales will overshoot. You’ll see negative capex growth numbers, just like we’re seeing or will see negative semiconductor sales numbers, and then they will delay it. When they suddenly wake up and realize, “Oh we’ve got to start investing again,” they will be at least a year behind the ball, just as they were in 2021, and just as they were in every previous upturn since then.

-

-

In October, Citigroup (aka “Citi”) cut earnings estimates for Texas Instruments, NXP Semiconductors, and Microchip Technology, with one of its analysts stating the following, according to Seeking Alpha:

We expect NXP Semiconductor (NXPI) and [Texas Instruments] will both report weakness in bookings and we reiterate our belief that this is just the beginning of the downturn and every company/every end market will feel it.

Bad news (perhaps) for employees and shareholders, good news (maybe) for customers waiting desperately for their orders to come through. All three companies are in the automotive/industrial market, which is the supply-constrained side of the 2022 split in the chip shortage.

Prediction Time

The situation makes me think of Alfred Hitchcock’s 1956 film The Man Who Knew Too Much. We seem to be reaching a kind of slow, dramatic crescendo in the mature-node chip shortage. It can’t last forever — can it? — and the suspense is killing me.

I’m going to state a conjecture and make a prediction. I don’t have any special information, and I’m not going to claim that I have a correct conjecture and prediction, merely that they are a possibility that needs to be considered.

The conjecture is that there is a long-term disturbance in the supply-demand equilibrium for mature nodes, and that the dynamics of the normal semiconductor cycle aren’t going to correct it, without the addition of some deliberate long-term shifts in supply strategy across the industry.

The prediction is that since the length of the semiconductor cycle is somewhere around four years, we shouldn’t plan on this taking less than two complete cycles, or eight years, for the industry to find out a better solution for mature-node equilibrium. Since this shortage was first in the news in December 2020 and became widely recognized by early 2021, that brings us to early 2029. Maybe.

That doesn’t mean that we’ll have to wait eight years for supply to catch up to demand — the analysts seem to be pointing to 2023 for a semiconductor downturn — but rather, I’m not expecting any mature-node glut to last very long, and then whammo! we’ll be back to more shortages. I don’t think we’re out of the woods until we have industry leaders stating confidently that they’re making a coordinated effort to do something different so that there is enough supply. Something on the order of the NTRS/ITRS roadmapping efforts.

Because right now, it seems like the CEOs are just doing what they can, letting us know what they see, and waiting for someone else to make a change so that their company can follow and join in. Most of the big, bold steps are at the leading edge.

Again, I’m just a guy writing a blog in my spare time; what do I know.

Something Is Happening Here, But You Don’t Know What It Is

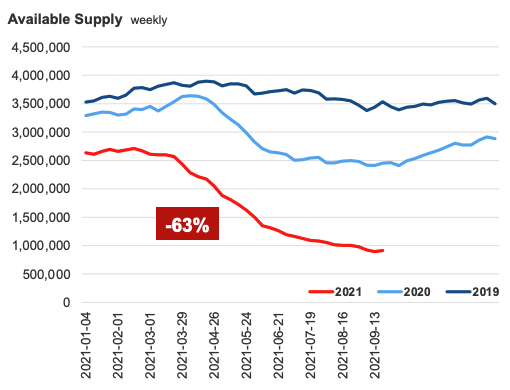

Let’s take a step back for a moment, and forget that we’re waiting on tenterhooks for something to change in 2022. Forget about 2020 and 2021, even. Sure, car companies lost their place in the chip line when the coronavirus first hit, as they hunkered down for the gathering storm, and when it turned out that what everyone really wanted was game consoles and laptops and cell phones and smart watches for something to do while stuck inside, there were never enough chips for the car companies to catch up — we’ve heard that narrative before, and now it’s time to put it out of your mind.

What’s been happening in the long-term, and how did we really get into this mess?

Abstract Neoclassical Economic Criticism 101

The real issue, as I see it, is that economics doesn’t guarantee a nice supply-demand equilibrium, and yet too many of us labor under the well-intentioned belief that it does — or that we should behave as though it does, and have faith that free enterprise will bring a solution whenever things get out of balance. The truth of the matter is that economic models are not that simple, and even simple economic models can demonstrate turbulence and instability. (Remember M.U.L.E. and the Smithore Gambit in Part Two?) In reality, all we can say is that there are economic forces that encourage equilibrium: when demand is sustained for something, there is a tendency for it to get more expensive, until there is enough of an economic incentive for someone to make more of it. And similar behavior is true in an oversupply: prices tend to decrease and drive the industry towards a self-correcting drop in production. Chip manufacturing is so expensive, and so time-consuming, and so large of an endeavor, though, that unbelievable amounts of supply-demand imbalance can occur before the underlying condition is fixed. Imbalance conditions can be rather “sticky”. We are finding that out the hard way.

To cut to the chase: this semiconductor cycle is different.

That is a big claim, and I’d like to think that it’s wrong, that Malcolm Penn is right, and this is just the 17th market downturn in the semiconductor industry, just another normal cycle. Vanity of vanities, saith the Preacher; the thing that hath been, it is that which shall be; and that which is done, is that which shall be done; and there is no new thing under the sun. To every thing there is a season…

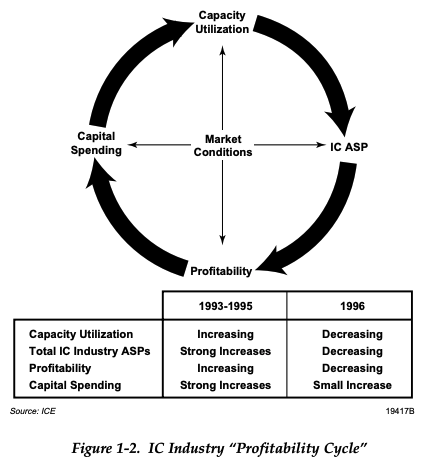

I talked about the semiconductor cycle in Part Two; in case you don’t remember, here is Integrated Circuit Engineering’s description of the semiconductor cycle:

Swings in production growth rate are closely tied to capacity utilization, ASPs of devices and capital spending (Figure 1-2). For the industry as a whole, when capacity utilization is high, ASPs rise and companies are more profitable, which in turn, encourages capital spending. However, with increased spending, capacity constraints loosen and ASPs tend to drop, decreasing company profitability. The decreased profitability (pre-tax income) then reduces the amount of capital available to invest in future needs.

There, like a wheel going round and round, or a pendulum swinging back and forth, with near predictable regularity every four years or so — heavily influenced by DRAM’s lurching capacity increases and price nosedives. The Economist cited IC Insights and Penn’s Future Horizons in January, saying a glut is coming:[2]

IC Insights, a research group, reckons that, across the industry, capital spending rose by 34% in 2021, the most since 2017. That torrent of money is welcome news for the industry’s customers, who have been struggling with shortages for over a year. For the industry itself, it is the latest iteration of a familiar pattern. Bumper revenues, like those reported by Intel on January 26th and Samsung the next day, compel companies to expand capacity. But because demand can change much more quickly than the two or more years needed to build a chip factory, such booms often end in busts. The chip business has swung between over- and undercapacity since it emerged in the 1950s, observes Malcolm Penn of Future Horizons, a firm of analysts (see chart). If history is a guide, then, a glut is in on the way. The only question is when.

And I don’t dispute that. The Preacher knows what he’s talking about. Tech companies are battening down the hatches for rough seas. Bloomberg just reported on Nov 11 that GlobalFoundries announced job cuts and hiring freezes — right after reporting what seems like great increases in revenue and income:[3]

The company based in Malta, New York, and majority-owned by the government of Abu Dhabi, is among semiconductor producers seeking funds from the US government via the \$52 billion CHIPS Act to expand domestic chip manufacturing. In planning layoffs and implementing a hiring freeze, GlobalFoundries is joining many of its peers in the broader technology industries.

Intel Corp. recently said it will undergo cost reductions, which Bloomberg News reported would include a significant number of job cuts. Other chip companies, including Micron Technology Inc., have slowed hiring. Meta Platforms Inc. has started widespread layoffs, while Qualcomm Inc., Twitter Inc., Apple Inc. and Amazon.com Inc. are among those that have paused hiring for many divisions.

On Tuesday, GlobalFoundries said third-quarter revenue jumped 22% and projected sales and profit in the current quarter that topped analysts’ estimates. The company is trying to win share in the market for outsourced chip production and gain enough scale to compete with industry leader Taiwan Semiconductor Manufacturing Co.

Tire Swings

What’s different, and a bit unnerving, is the mature-node situation. If you think of the semiconductor market as a bunch of tire swings, hanging from a big tree, regularly moving back and forth between overcapacity to undercapacity — look, there’s the one for memory and there’s the one for PC/mobile microprocessors, back and forth, there they go…

Photograph "’09" © 2009 kristina sohappy,

used under CC BY 2.0 license, desaturated from the original.

Well, one of the tire swings covers mature nodes, and it’s been pushed so hard it’s gotten stuck on a rock ledge or a tree branch.

It’s not the biggest tire swing, by any measure. Here’s that table of semiconductor manufacturers again:

Table © Semiconductor Intelligence, LLC, reproduced with permission.

The auto/industrial market doesn’t show up until you get to manufacturers #10-14 — and even then, it’s just a portion of their business. Once upon a time this wasn’t the case; TI and Motorola were regularly at the top. In 1988 the top semiconductor companies by revenue, according to Dataquest, were NEC, Toshiba, Hitachi, Motorola, Texas Instruments, Fujitsu, and Intel, in that order.[4] The market has shifted, though, with mobile devices now a big part of the picture.

In other words, this sustained mature-node chip shortage is only a small part of the semiconductor market… yet an important one. The term “golden screw” has been bandied about: when someone is building product X, if you’re missing one tiny “golden screw”, even if you have all the other pieces, you still can’t complete production. I am not sure when this term made its way into the collective consciousness of the electronics industry, but the first instance I could find was in a November 2021 article in Fortune quoting Infineon’s Helmut Gassel:[5]

Infineon, the world’s largest supplier of semiconductors to the automotive industry, reported on Wednesday that the cost of outsourcing its production to chip foundries is set to climb steeply.

Unhappy about sinking money into fresh capacity for outdated processors, these specialized high-volume chip manufacturers want their investment costs covered in exchange for churning out more semiconductors.

“For this fiscal year [to end of September], we have secured somewhat more foundry capacity, but it’s for sure not anywhere close to what we need,” said operations chief Jochen Hanebeck.

For now, Infineon is living from hand to mouth, prioritizing shipments to those customers where the demand is greatest.

The majority of its job, according to marketing chief Helmut Gassel, is taking the chips they can get from the foundries and assigning them based on the greatest economic benefit to their customers: “that which is needed most at a given moment — the ‘golden screw’ so to speak, without which the rest of a product cannot be built.”

Part of the reason for the problem is a general concern in the chip industry — Infineon included — not to chase too much demand and overinvest. The fear of building up excess capacity that in the coming years will erode profits remains part of the collective memory of Infineon from the DRAM glut during the 2000s.

Yet that solves only part of the problem.

Infineon would ideally prefer to invest in its own production of specialized semiconductors like inverters for power electronics, a product segment where foundries are absent. Yet the bottlenecks have gotten so bad that Infineon sees no other alternative than to invest in its own capacity in Dresden to produce certain outdated microcontrollers, something it is typically loath to do for commodity chips.

Hmmm. Not economically desirable, but necessary as a last resort. In Part Two we saw in M.U.L.E. that when goods are scarce, the price goes up, and rational economic actors will take advantage of the situation to add supply. The tire swing is stuck, and we’re all just waiting for it to come down again, but it’s not. Somebody has to do something about it.

TSMC, as I mentioned in Part Three, is doing something about it, by adding more capacity — on 28nm. Meanwhile, we’re still waiting for that 40nm - 90nm tree swing to come down. As Anton Shilov mentioned on AnandTech:

But the cheap wafer prices for these nodes comes from the fact that they were once, long ago, leading-edge nodes themselves, and that their construction costs were paid off by the high prices that a cutting-edge process can fetch. Which is to say that there isn’t the profitability (or even the equipment) to build new capacity for such old nodes.

This is why TSMC’s plan to expand production capacity for mature and specialized nodes by 50% is focused on 28nm-capable fabs. As the final (viable) generation of TSMC’s classic, pre-FinFET manufacturing processes, 28nm is being positioned as the new sweet spot for producing simple, low-cost chips. And, in an effort to consolidate production of these chips around fewer and more widely available/expandable production lines, TSMC would like to get customers using old nodes on to the 28nm generation.

“We are not currently [expanding capacity for] the 40 nm node” said Kevin Zhang, senior vice president of business development at TSMC. “You build a fab, fab will not come online [until] two year or three years from now. So, you really need to think about where the future product is going, not where the product is today.”

Okay, maybe the price hasn’t climbed up enough to motivate more capacity? That tree swing should come down soon. Yep. Any day now....

Scooped by Doug, Kurt, Steve, Ganesh, Willy, and BCG

I’m doing this part-time, so it’s taking me a long time to research all this stuff and write it up. A few others who are involved more closely in the chip shortage have discussed the issue more quickly than I have; they’ve made some astute comments, which I wanted to share.

Fabricated Knowledge, Nov 2021

Doug O’Laughlin at Fabricated Knowledge wins first prize for bringing up the mature-node capacity conundrum in November 2021, in his article The Rising Tide of Semiconductor Cost.[6]

It’s not just the newest, fastest, and most expensive chips that are costing more because of technological problems. The most interesting trend recently is that old chips are starting to drive price increases. The recent inflection in Automotive semiconductors is driving demand, not for the latest and greatest, but older and more mature technologies. The problem is that there never has been meaningful capacity added for older technologies, and most of the time fabs would just become “hand-me-downs” as the leading edge pushed forward and the fab equipment would continue to be used and depreciated. Using fully depreciated fab equipment meaningfully lowered the cost to make a semiconductor, especially after 10+ years.

That’s been an important aspect of pricing. A fab being maintained without much incremental capital, yet still producing chips, is what has driven down the price of older chips so much over time. Often there would even be improvements in yield, which further lowered costs. The thinking went that a leading-edge chip that cost hundreds of dollars in 2000 would cost pennies in 2021 because the fab would be fully depreciated.

But there’s a problem with that. We have a situation that’s never happened before. Historically, demand was clustered toward the leading edge. Today, we have demanded at the lagging edge, too. In fact, the demand for older chips is starting to rise sharply. This is driven by automotive and IoT production, as most of these applications are older, more mature technologies, which have better yield, cost, and, importantly, reliability. And even though demand has spiked, no capacity has been added. It’s very rare to add to lagging-edge production.

Up until very recently, there was ample capacity at the lagging edge. It would have been unheard of to add capacity to the lagging edge. A fab was considered “full” if it was running at 80%. Now, trailing-edge fabs are running at close to 100%. Something must change.

This is one of the drivers of the automotive semiconductor shortage: higher demand and no supply or incentives to add more supply. Most semiconductor firms and fabs are obsessed with the leading edge because they can make higher profits. Now firms are waking up to maintaining the lagging edge. The “old” chips are becoming just as important as new chips, and to add capacity, firms had to start making large capital additions again.

There are obvious pricing problems in this scenario. With a new fab, a company can’t turn a profit selling a lagging-edge chip at the price that was previously dictated by a fully depreciated fab. Prices have to go up.

O’Laughlin then quotes Silicon Labs’ CFO John Hollister in the company’s October 2021 earnings call,[7] talking about the normal routine of fab hand-me-downs:

Hold on just one — just in terms of the cost increases and the durability of that, I think that we are going into kind of a new phase of the semiconductor industry, where we’ve got Moore’s Law and advanced nodes becoming more and more expensive and you’ve got mainstream technology now full. And it used to be that the digital guys would move out and the N minus one, N minus two, N minus three nodes would those would be fully depreciated fabs that you would move into. We have now reached a point where the mix, the ratio between advanced and mainstream is causing fabs TSMC and others to build new mainstream technology, and that means that those fabs are not fully depreciated.

So a large element of the cost increases that the industry is seeing right now is because of the additional Capex that’s having to be put in to build new capacity across the nodes, not just at the advanced nodes, but across. And so if you look at the cost increases that we’re seeing in other — it’s across the industry, there is a certain element of that, that’s durable over time. And so this is a step function in terms of the cost structure of the industry to match the demand that we’re seeing and the increasing content of electronics throughout the economy and the acceleration of demand that we’ve seen through the pandemic has really push that forward and driven us into the supply constraints.

We’ll work through that, but to work through that is requiring a lot of Capex, and that’s got to be recouped. And that’s got to flow upstream from our suppliers to us, to our customers and that’s what you’re seeing right now.

O’Laughlin goes on to state that supply constraints at the lagging edge are likely to continue, something that is “completely new territory for the industry”:

There is really only one solution — adding capacity — but fabs are uncertain they could make a profit adding greenfield lagging edge without raising prices. In turn, they’re concerned about the demand for these “new” lagging-edge chips.

It’s a standoff. Fabs and semiconductor companies are uncertain that this will last, but Auto OEMs and the like seem to have insatiable demand. For a fab, it’s hard to change your behavior in one year against a trend that has lasted decades. Even harder is to go through those difficult changes and expect customers to accept higher prices.

I’m just quoting here, so if you want to read more, I’d suggest reading the original article. It’s now been a year, and things really haven’t changed much. Everybody’s hoping the tire swing will come down and get back to normal.

NXP, September 2022

NXP participated in Citi’s Global Tech Conference in September 2022, with CEO Kurt Sievers engaging in quite a candid discussion with Citi’s Chris Danely. I’ve posted an extended transcript below in the Addenda section, but here are some highlights:

- The worst constraints are at the foundries in the 28 - 180nm range

- In addition to working on increases in supply, NXP is engaging in more direct communication with car companies to understand future demand

- Decrease in demand from PC/consumer/mobile doesn’t affect supply at these constrained nodes

- NXP purchases finished wafers from the foundries in the 90nm to 5nm range, making up about 60% of their supply — not clear if this is revenue or number of wafers — and is expected to grow to 70-75%.

- NXP believes it is covering 80% of its true demand (after discounting possible double-orders) by its supply capacity.

There are two areas that I want to cover in a little more detail.

One is on the topic of non-cancelable orders.

Sievers stated that much of what NXP considers as true demand from its customers — and it’s only able to service 80% of this demand — comes from non-cancelable orders, much of which are in the automotive and industrial markets:

A lot of that is these famous NCNR orders, which are the non-cancelable non-reschedulable orders, where in the meantime, the level of those for next year is bigger than what we have for this year. I mean, it’s just important in the current environment where everybody fears about the macro breaking together and whatever, our NCNR order level, which is firm, confirmed orders through the end of next year, are bigger already now than what we have for this year, with a move between— inside the portfolio.

So, we have none of those anymore for mobile, which is probably not surprising to anybody, but we have a significant increase in industrial. Automotive is about the same, which is in line because automotive was the first to escalate. So, a lot of our automotive customers gave us these orders already early for ’21, and they continue to do for ’22.

In industrial, industry has only found out too late, so they were too late to give us these NCNR orders for ’21, for ’22 — so the learning was now to be early to do this for ’23. So, we see a significant uptick, actually, in these NCNR orders for next year. But all together 80% coverage. Now, I don’t know how things move going forward, but that gives you a feel on how robust that still is.

The increase in “commitment” activity in the semiconductor industry (NCNR being one example) is a change that’s come out of the chip shortage. This is involved in both sides of NXP’s supply chain, with commitments also between NXP and its foundry suppliers:

Kurt Sievers — I mean, I can be very open what we have, we have like \$4 billion of supply, or purchase obligations from our perspective, from foundries, which sounds like a big number, but if you know that this is spread more or less evenly over five years, and we do in the quarter more than \$3 billion revenue, then it’s not much at all. It’s actually a pretty small number. And it’s more than out-balanced by NCNR commitments which we have from our customers.

Chris Danely — Yeah. So, it just kind of moves on down the line, right?

Kurt Sievers — Philosophically, I think it is a good concept, because especially in these industrial and automotive markets, design wins and the lifetime of design wins are very lengthy. So, there is enough visibility to enter into these kinds of agreements. And I think it just helps the whole supply chain. So, in principle, I think it’s a good thing. And it goes a bit away from this call-by mentality, which we might have had in the past.

Is it going to cover everything going forward? No, I definitely don’t think so. But for certain deals and certain specific single-source components, I think it’s a good move.

Chris Danely — Has it changed the capital intensity at all, up or down, these upfront payments? Or is it just the same part, you’re just paying a little more earlier?

Kurt Sievers — It’s not even always that we have to pay something upfront. It’s more the obligation that we take it over time. So, but there is all sorts of constructions, I mean, that there is different deals with different foundries, I guess, by all of our competitors doing, everybody is doing a little bit his or her thing?

No, I don’t think overall it changes the capital intensity, but it hopefully forces people to be more thoughtful about what future demands are. And with that, what future investments we should actually take or not take.

And the second topic is price increases, which Sievers summarized as follows:

First of all, the policy we have very transparently taken right from the start is that we will pass on all of the increased input cost to our customers in such a way that it exactly protects our gross margin percentage. Not abusing it to pad gross margin, but also not being the victim in the middle, which is losing profitability on this.

We’ve done this right from the start, I think Bill and I had a very sharp eye to be really precise on this, and we are very open to our customers, this is how it works. And so far, we have found reasonable, I would say acceptance. I mean, raising prices is never easy, but I would say, so far so good.

I do not think this is behind us. At least in the technologies and process capacities which we need. I dare to say it’s— it looks pretty obvious that our input costs will continue to go up next year. So, we are somewhere in the middle of it, but it continues, which also means that NXP will have to raise prices also next year. So, we are not at the end of this. And that has to do with the fact that foundries keep investing into these mature nodes and there continues to be a supply and demand imbalance in these mature nodes.

The topic of price increases is a tricky one. If I put on my customer/consumer hat, when I hear price increases I have one of those visceral reactions — NOOOOO!!!!! — because I know it’s just one more burden for people to bear, and it adds to the inflationary environment. But from an economic perspective, price increases are important to alleviate the supply-demand imbalance. For a company like NXP, if it charges more, then it should incentivize lower demand from its customers. If NXP’s foundry suppliers charge more, then that should help incentivize the creation of more fab supply. Both should help bring supply and demand toward equilibrium.

NXP’s strategy is the “honest shopkeeper” approach to maintain gross margin, passing along what it thinks is a fair and transparent price increase to its customers, to maintain a healthy relationship with those customers. It’s a middle ground between eating the cost increases — which is what would happen with a commodity if one producer’s costs increased but the commodity price stayed constant — and price-gouging. Is that the best choice in this drastic shortage? I don’t know; it’s something to think about.

Microchip Technology, May 2022

Steve and Ganesh are the top executives of Microchip: Steve Sanghi, Executive Chairman of the Board, and Ganesh Moorthy, President and CEO. They’ve been commenting on the chip shortage regularly in earnings calls. Here they are in May 2022:[8]

Christopher Rolland (Analyst, Susquehanna International Group) — Great. Thank you, Ganesh. And then one for either you or Steve. A lot of people have talked about potential over capacity for the industry in ‘23 and ‘24.

Would love to get kind of your views on whether you think that’s a thing or not? And what its effect on industry pricing might be? Thanks.

Ganesh Moorthy (President and Chief Executive Officer) — So I’ll give you my view and then maybe Steve will add to it as well. So it’s a bit of a misnomer when you talk about overcapacity in ‘23 or ‘24. When you look at where is the capex being spent by the industry, right? Industry spent over \$100 billion of capex last year. The vast majority of that capex, over 90% of it, is being spent on the bleeding-edge nodes.

These are the nodes that are 16-nanometer and smaller, so 16, 10, seven, five, three, etc., is where all that is being spent. Where the capacity is not being invested in at the rates that are required, and where, for example, all of the constraints that the industry is fighting through — short, medium, and long term — are on these trailing-edge, specialty technologies. On 300-millimeter, that is typically anything which is 40-nanometer and larger in size: very little capacity investment coming online to be able to help that. On 200-millimeter, eight-inch wafers, there’s almost nothing that is being done, outside of what some of the IDMs have been doing, and which really is still a far cry from what is needed.

So while there is capex spending taking place, of quite significant amount, it is being spent disproportionately on the bleeding-edge technologies, and there are still significant constraints left on the trailing-edge, specialty technologies that we don’t see easing up into ‘23 and ‘24. Steve, do you want to add some more to it?

Steve Sanghi (Executive Chairman) — Yes. Yes, I would. So what has happened historically is that the foundries built a leading-edge fab, depreciated it fully over four years, providing leading-edge chips to the likes of Qualcomm and AMD, and others. And when the leading-edge guys moved to the next node, then they took that capacity, a depreciated fab and repurposed it for microcontroller, mixed-signal, connectivity, and those kind of products.

And that’s how over many, many years, trailing-edge capacity became available. Now what has happened now is that link is broken. The leading-edge lithography has gone to 14-nanometer, 10-nanometer, even seven, five, and three-nanometer, while the microcontrollers and analog, because of functionality needed, are still in the range of 65-nanometer to 180-nanometer. And so, therefore, the trailing-edge capacity no longer easily becomes available, because somebody moved to the next node.

Secondly, starting at 90 nanometer, the wafers became 12-inch, less than 90 nanometer, the wafer’s at eight-inch. And eight-inch is largely aluminum back-end and 12-inch is largely copper back-end, and one is not compatible with the other. So a 12-inch fab becoming available, doesn’t easily give the capacity for an eight-inch product to move to 12-inch. So combination of those factors and the fact that the foundries are adding almost no capacity on the trailing edge, it is quite possible that the trailing-edge capacity is forever constrained.

And that’s why we are making aggressive attempts to add capacity internally to provide that growth to our business and to our customers, and you’re seeing some of our competitors do the same thing.

Wait, what?

it is quite possible that the trailing-edge capacity is forever constrained.

I don’t know that I agree with Sanghi on “forever”, but there is no easy answer here, and it’s going to take time for the industry to come to some kind of agreement. TSMC isn’t rushing in to save the world, and you’re hearing companies in this space, like Microchip and TI, essentially go it alone. I mentioned in Part Three that the only way Moore’s Law keeps on chugging away at the leading edge is a coordinated effort. It lowers risks just enough to make the financing work. Going alone is a tough road.

As for TI: it’s a large enough company that it is pursuing several 300mm capital expenditures at once, something I mentioned in Part Two.

For Microchip, there was some really interesting news in the November earnings call, namely the possibility of a 300mm fab:[9]

Ganesh Moorthy — While we are seeing some loosening of constraints in our supply chain, we continue to have several internal and external capacity corridors that remain very constrained. We are continuing with our carefully calibrated capacity increases, seeking to serve what we believe is a long-term consumption growth. We believe our calibrated increase in capital spending will enable us to capitalize on growth opportunities, serve our customers better, increase our market share, improve our gross margins, and give us more control over our destiny, especially for specialized trailing-edge technologies.

As you may have seen, Microchip has expressed its view that the recently approved CHIPS Act is good for the semiconductor industry and for America, as it enables critical investments which will even the global playing field for U.S. companies, while being strategically important for our economic and national security.

For a very long time, an important component of our business strategy has been to own and operate a substantial portion of our manufacturing resources, including wafer fabrication facilities in the U.S. This strategy enables us to maintain a high level of manufacturing control, resulting in us being one of the lowest-cost producers in the embedded control industry.

In light of this strategy, and potential grant funding from the CHIPS Act, the Investment Tax Credit provision, as well as state and local grants and subsidies, Microchip is in the early stages of considering a 300-millimeter U.S.-based fab for specialized trailing edge technologies.

This fab project, if we decide to pursue it, would be intended to provide competitive growth capacity as well as geographic and geopolitical diversification. The availability of grants, subsidies, and other incentives will all be important considerations in our analysis, and will also help determine the location and timing for the fab.

In the later Q&A session, Moorthy mentioned the potential 300mm fab would not be a quick effort, that it is “something we think about over a 20-year-plus time frame” and

I think on 300-millimeter, where — if we started on a fab tomorrow, it’s 4-plus years away before that fab is starting to ramp. So these are not decisions we make in a single cycle. We think through these across cycles on a long-term secular growth basis and what our position is and what we want our capabilities to be out in time.

Moorthy also handled a question about the mix of process nodes in a 300mm fab:

So firstly, on process technologies, those are still being worked. But largely, we use our 300-millimeter foundries today on process technologies that are 90-nanometer and smaller in size. And the workhorse technologies for trailing-edge tend to be at 40, 65, 90, in that general neighborhood. But those — we wouldn’t limit ourselves just to that. Again, I want you to think of this as— this is a 20, 25-year look at what we would do with the 300-millimeter fab. The reasoning for it is we have — as our business has grown, the portion of our business that we do with 300-millimeter has also grown. And the investment in the trailing-edge part of 300-millimeter technologies has not been there with many of our foundries at the level that we have wanted. And — but it takes a certain scale to get there.

And if you had a full-boat fab that you needed to build, the way in which the breakeven points and the absorption points come about are different from when there is a fab that can be built with government funding and the Investment Tax Credits and whatever local things come in. So clearly, that has changed the equation as to when does it make sense financially. But that’s not the only reason why. We think trailing-edge 300-millimeter technology is going to have constraints for a long time to come and a portion of that being within Microchip would allow us to better serve those markets.

There are those 40-90nm nodes again. The question remains — will there be enough justification to build a 300mm fab, even with CHIPS Act funding? And if not, how is Microchip going to obtain capacity in this range?

Willy Shih

Willy Shih is a supply chain expert and a frequent contributor to Forbes Magazine. He’s written about the semiconductor shortage several times. Here are a few excerpts.

From Aug 3 2022 while commenting on the CHIPS Act:[10]

Chip shortages were caused by changing demand patterns brought on by the pandemic. There was a burst in demand for work-from-home gear like notebook computers, appliances, and other goods, and manufacturers had a hard time shifting production. I explained this a while ago, but it’s important to understand that several issues have gotten conflated here: loss of leadership on the high-end, but an inadequate capacity to meet the surge in demand for trailing-edge technologies (i.e., the older stuff that is no longer leading-edge). Capacity for trailing-edge technologies was tight before the pandemic because making those kinds of chips is not particularly profitable and you want to run your factory pretty fully loaded so you can make some money. If you build a new factory with some of that subsidy money, when it comes on stream in two-plus years it will certainly help with the shortage. But by then, a lot of people are already worrying about a glut, because manufacturers have already been adding capacity like crazy.

From Nov 3 2022, explaining how the market segments have behaved differently and why we still have a mature node shortage:[1]

Most automotive semiconductors are produced on “mature” nodes. A recent McKinsey report stated that most of the demand in this sector was for 90 nm and above. For perspective, the 90 nm node was the bleeding edge of chip technology around 2002, twenty years ago. Partly this was because the types of components used in vehicles didn’t benefit from newer technologies, and there is a long and expensive process to move them to more modern nodes. The factories making these chips use older tools, and since these are not terribly profitable commodity parts, there has been little incentive to invest in growing the capacity. Capacity was already tight before the pandemic, and then during a roughly eight-week period in 2020 when car factories were mostly shut down, most of the OEMs pulled back their orders. Meanwhile an explosion in demand from other sectors filled all that manufacturing capacity, so when the automakers came back to reorder, the lead times had extended way out. They are still catching up.

And most recently, from Nov 20 2022, focusing on the automotive chip shortage itself:[11]

There are several standout features of automotive chips. The first is that they must operate for a long time over wide temperature extremes while subject to lots of shocks and vibrations. Automakers expect an operating lifetime of 15 years and tolerate a failure rate of zero parts per billion during that time. They also want replacement parts to be available for 30 years. Most consumer electronic devices (like your phone) have failure rates measured in parts per million and would be considered obsolete after five years. If your PC encounters an error, reboot and give it another whirl. If your engine controller suddenly fails, you don’t pull over to the side of the road and reboot (although I have heard of something like this happening with an electric vehicle’s infotainment system). The Automotive Electronics Council (established by the Detroit Big Three) maintains a range of qualification standards for chips. For operating temperature, it defines Grades 0, 1, 2, and 3 operating ranges, with Grade 1 covering -40°C to +125°C and Grade 2 from -40°C to +105°C. That has a high-end limit hotter than the temperature of boiling water, by the way. This is a considerably more challenging range than most consumer chips will ever see. The chips need to be reliable, so they must be designed and tested to have a sufficient operating life under extreme conditions.

The second requirement is they must be designed with safety in mind. A lot of this is covered by ISO 26262 – Functional Safety Standards, which covers a range of things beginning with how they are designed to how failures are handled.

Finally the processes for making chips at semiconductor fabs have to be “qualified,” which typically takes six months. The fabs also need to have modifications to their process design kits for high temperature device models, thicker interconnects, and other things that enhance reliability. After that the chips must be extensively tested before they can get built into vehicles. That means accelerated life testing at elevated temperatures and harsh conditions to simulate many years of service. Mainstream automakers have taken as long as 3-5 years to design, test, and validate new chips.

I pointed out earlier that many automotive microcontrollers use 90 nm technology, and it has been difficult to add capacity. The shortages over the past two years have prompted some automotive chip vendors to migrate to 65/55nm nodes, and some have even jumped to 40 nm. But DigiTimes says it will take as much as five years for the new chips built with 40nm processes to clear validation processes and get put into new vehicles, which means the existing technology will be in use for some time to come. And that’s why the auto chip shortage is talking longer than most to alleviate.

I agree with most of Shih’s points, but there’s an assumption here, and that is that 90nm is the problem child and 65/55nm and 40nm are better in terms of availability. As I mentioned in Part Three, we don’t have a lot of visibility to this; TSMC did discuss this in a January 2021 earnings call:[12]

Robert Duncan Cobban Sanders (Deutsche Bank AG, Director, Research Division) — Yes, I just got one question, actually. Just could you please then comment more on the wafer shortage situation and how severe it is at present? Which node are you seeing the shortage most acute? Is it 65-, 90-nanometer, 0.11, 0.13, whatever it is? And how far out are you essentially booked out at some of these nodes? And do you think there’s wafer upside to what you’re pricing at these nodes?

Jeff Su (TSMC, Director of Investor Relations) — Okay. So Robert, your question is on the tightness or shortage in the wafer. He is asking, is it at particular node such as 65-nanometer, 90-nanometer, 0.13, how short it is and how long it will last.

C. C. Wei (TSMC, CEO) — Robert, most of the shortage actually is in the mature node. It’s not in the 3-, not in the 5- or 7-nanometer per se, but in all the mature node, especially in 0.13 micron, in 40-nanometer, in 55-nanometer, in those area.

Kudos to Robert Sanders for asking. But that was nearly two years ago. The analysts have had seven earnings calls since then, and none of them have brought it up again. :-( So we don’t know how things have played out. The closest TSMC has gotten to this topic was in the July 2021 earnings call, in a response to a question from Krish Sankar of Cowen and Company, about the technology nodes used by TSMC’s automotive customers:

C. C. Wei (TSMC, CEO) — Krish, I think I have mentioned that automotive MCU is the biggest one that we have and it’s in 55-, 40- and 28-nanometer with the majority still in 55 and 40. And in the next 2 to 3 years, it will be moved to 28-nanometer. That’s in our current plan, and we are working with our customers on that.

This sounds promising, but I still don’t see that things will magically be solved in the next few years. I pointed out in Part Three that the economics are prohibitive for smaller low-cost chips to move to more advanced technology nodes, except at incredibly high volumes, because of the increase in up-front design and manufacturing costs.

Mobile phones and other consumer electronics are able to take advantage of the cost savings of semiconductor integration by combining functions into one chip: more complex integration on a chip opens the door to using a smaller technology node. In the automotive industry, this is not so easy — notably because cars and trucks are physically large objects. I can say with certainty that there will never be a single car-system-on-chip, because there are so many sensors and actuators and inputs and outputs distributed around an automobile. The industry is trying to get at least some benefit out of integration, through zone controllers to simplify the interconnection between different sections of automotive electronics… but I’d be willing to bet that in 20 years you’ll still see some individual MCUs or voltage regulators scattered around inside a car, and they’ll be using a technology node that makes the most financial sense for each chip.

Boston Consulting Group

Boston Consulting Group put out a report recently (October 2022), titled Automotive Industry Semiconductor Outlook, along with a summary article[13] that starts out ominously:

The semiconductor shortages that have plagued the automotive industry may persist in some form through as late as 2026.

Yikes! Pardon the interruption; that was just a knee-jerk reaction of mine. I’d better let the BCG folks continue.

The semiconductor shortages that have plagued the automotive industry may persist in some form through as late as 2026. Pandemic-induced manufacturing and logistics challenges are easing; consumer chip demand has reached a saturation point and is in a cyclical decline. But continuing growth in automotive semiconductor demand is inevitable, as penetration of semiconductor-intense automotive applications, such as higher levels of advanced driver assistance systems (ADAS) and electrification, increases.

The growing sophistication of vehicles means that, despite recent capacity investments, the imbalance between chip supply and demand will persist—at least for some types of semiconductors—over the next four years. However, the nature of the chip shortages and the device types affected will change over time, requiring automakers to actively manage risks as the situation evolves.

Here’s the lead content from the report itself:

The automotive semiconductor market is expected to grow by more than 9% annually through 2030.

- The adoption of electric vehicles (EVs) and advanced driver-assistance systems (ADAS) will substantially increase the semiconductor content in vehicles, even as production volume remains steady.

- Battery electric vehicles (BEVs), which are expected to have the highest market share among EVs by 2026, have twice the semiconductor content of internal combustion engine (ICE) vehicles, owing to the need for discrete-power and analog chips.

- ADAS Level 2+ is expected to gain the largest market share among assistance systems. Each additional level of sophistication exponentially increases the need for memory and logic computing.

As a result, some semiconductor supply challenges are expected to persist through 2026.

- Shortages of analog chips and MEMS may persist given limited planned-capacity investments.

- Discrete-power chips may experience additional demand pressure with the adoption of 800-volt vehicles; there may be insufficient wide-bandgap manufacturing capacity to meet demand.

- Approximately 50% of future fabrication capacity is planned in mainland China, which will increase risk if the planned capacity does not come online or is inaccessible to Western OEMs and Tier 1 suppliers.

- Automotive demand growth will be highest for logic chips made on 20nm to 45nm nodes in order to meet the increasing computing needs of centralized electrical/electronic architectures; we expect this to ease demand pressure on mature node sizes larger than 55nm.

There’s a lot to parse here, but the report itself is an easy read, at only 14 pages of content, mostly consisting of graphs and charts and bullet points, like this one on page 13:

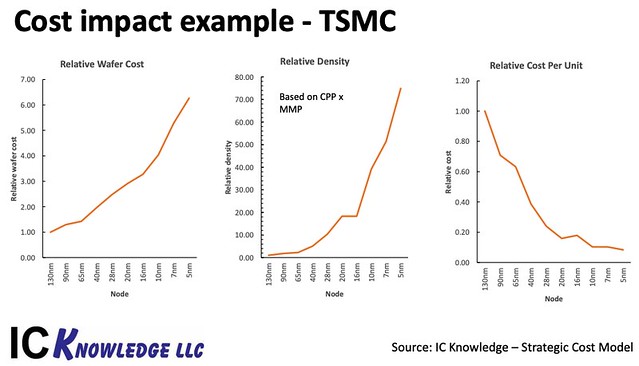

This gets into some of the issues I mentioned in Part Three, namely that new mature-node fabs can’t compete economically against existing depreciated fabs at the same technology node. But the “28nm is the current sweet spot for cost-per-transistor” meme is unsubstantiated, and contains unwritten assumptions — at what volume? at what die area? including or excluding design costs? I’m more inclined to believe Scotten Jones’s relative-cost-per-unit graph from Technology and Cost Trends at Advanced Nodes[14] — I included this graph in Part Three, which shows the cost-per-transistor still decreasing down to 5nm.

Slide used by permission of IC Knowledge LLC.

But again, the only catch is that the volumes need to be high enough so that the costs of design and masks don’t negate that cost advantage.

At any rate, the BCG report raises a number of issues, of which you can get a sense just by reading the slide titles:

- Pandemic-induced manufacturing and logistics challenges are easing, but supply issues will persist

- The auto industry currently occupies a small share of the semiconductor market, but it’s growing rapidly

- Increasing semiconductor content per vehicle will promote demand, even as total vehicle production remains steady

- BEVs are expected to have the largest share of the market and require the most semiconductor content

- On average, BEV powertrains require more discrete-power chips and analog content than internal combustion engines

- ADAS Level 2+ will see the highest penetration growth through 2030, increasing demand for logic and memory

- Analog and MEMS will be the key semiconductor challenges through 2026

- Automotives’ transition to more advanced logic nodes should ease demand pressure on mature sizes larger than 55 nanometers

- For nonlogic chips, automotive growth will place stress on analog and MEMS

- Uncertain access to mainland China’s fabrication capacity may increase risk in the automotive supply chain

- Outside of mainland China, underinvestment in mature capacity persists owing to a cost penalty for new fabricators and older chips

- Automotive OEMs are implementing new semiconductor engagement models

I’m not sure I agree with all of the conclusions, but I think most of BCG’s points are worth considering.

Aftertastes: Takeaways After Digesting Five Scoops

There’s a lot of turbulence and uncertainty and signs of continued supply-demand imbalance ahead.

I think the biggest lesson is that we cannot take the dynamics of the semiconductor markets for granted. It’s not always like DRAM uniformly across the industry, with building-new-capacity to the rescue that then causes a glut and leads the way to the next shortage — a roller-coaster ride where there’s just enough uncertainty in timing and magnitude to keep life interesting. There are enough respected voices out there raising reasonable concerns. And we ought to at least keep an eye on things for the long term.

What about the short term? What else has been going on in 2022, and what’s in the tea leaves for 2023?

Clues from Earnings Calls

I’ve been reading transcripts of this years’ quarterly earnings calls from a number of companies. The ones most relevant to the continuing chip shortage, aside from the foundries, are probably the larger industrial and automotive semiconductors manufacturers with their own fabs. These include:

- Analog Devices

- Diodes Incorporated

- Infineon

- Microchip Technology

- NXP

- onsemi (formerly ON Semiconductor; I prefer company names that are capitalized to avoid awkwardness, so will be referring to them as ON Semi)

- Renesas

- ST Microelectronics

- Texas Instruments

The earnings calls are a chance for company management to present and interpret on what’s happened during each quarter, and for financial analysts to ask questions. I mentioned in Part Two that this is a prime chance to find out something interesting besides the accounting numbers. The analysts are always searching for any forward-looking signals in the wind, like trackers eager to catch a scent of their prey. And there’s a lot of interesting little tidbits that have happened in 2022’s calls. Here are a few themes that have come up in the last twelve months.

(And again, nothing in this article should be construed as investment advice.)

Increasing internal manufacturing capacity

All of these companies mentioned increasing internal manufacturing capacity in at least two earnings calls in the past twelve months.

In this subsection and the following ones, I’m going to show a bunch of tables like the one below, which list a checkmark when I noticed a topic was mentioned in the earnings calls. (Lack of a checkmark doesn’t mean they didn’t mention it; I may have missed some.) The column labels Q1 - Q4 represent the calendar quarter in which the earnings call took place — Q1 = January – March, Q2 = April – June, Q3 = July – September, Q4 = October – December — and refer to the preceding quarter’s results. (Note that some companies use a fiscal year that does not line up with the calendar quarters, like Analog Devices, whose fiscal year ended October 29, and Micron Technology, whose fiscal year ended September 1. I didn’t cover Micron in this article because they’re in the memory segment, which has its own not-so-little market dynamics — see Part Two — that are not really impacting the automotive chip shortage.)

| Increasing capacity | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

Analog Devices | ||||

Diodes Incorporated | ||||

Infineon | ||||

Microchip Technology | ||||

NXP | ||||

onsemi | ||||

Renesas | ||||

ST Microelectronics | ||||

Texas Instruments |

What’s not available is a sense of how much they are increasing capacity. We can look at numbers about revenue, but unless they’re touting new fab construction or purchases, it’s hard to tell whether “increasing capacity” means they added 1% more manufacturing capacity, or they doubled it. Some highlights:

-

Diodes Incorporated bought ON Semi’s fab in South Portland, Maine, and has been ramping down capacity commitments from its “GFAB”, TI’s former fab in Greenock, Scotland. I don’t know how often this happens, but to smooth out the disruption in production, sometimes a fab sale is accompanied by an agreement to continue production for its former owner. In this case it means that Diodes Inc is still producing a decreasing amount of chips for TI at the Scotland site, but gradually the fab output will ramp up for their own production. From the company’s May 4 call:

If you look at the GFAB we purchased in year 2019. That facility, we are supporting Texas Instruments, and that support is coming down 10% a year, the loading coming down 10% a year. Therefore, we already start to qualify Diodes’ product to ramp it up in that area – I mean in that fab. So, you can see when Texas Instrument demand or our commitment to the Texas Instruments are down 10% each year, we can go up 10% to support our own demand. And remember their 10% and compared with our number there, then wafer is much more than what we’re talking about 10%. So that is GFAB. Then, obviously, you already know our acquisition for the wafer from onsemi, and that we expect to close next month or end of this month, that’s what we expecting. Okay.

-

TI: increases in capacity in Richardson, Texas, bringing the former Micron fab in Lehi, Utah online, and two new fabs coming up in Sherman Texas — see Part Two, and numerous other recent articles; for example, EE Times covered the company’s analog expansion in October:[15]

Not that anyone needed more proof that the analog segment in the electronics industry is booming, but Texas Instruments (TI) is serving it up anyway: On Sept. 29, TI announced it began initial chip production at RFAB2, a new 300-mm analog wafer fab in Richardson, TX, that is connected to RFAB1, its 13-year-old 300-mm analog wafer fab. A few years from now, the pair will be able to produce more than 100 million analog chips every day, TI asserts.

-

ON Semi: opening of a new silicon carbide fab in the Czech Republic

-

Infineon: recent opening of 300mm fab in Villach, Austria (capacity ramp mentioned in May 9 call), and mentioned the upcoming construction of a fourth fab at its Dresden site in its November 15 call.

-

Renesas: new 300mm fab at Kofu Factory, mentioned in its July 28 call.

-

ST Microelectronics: several major CapEx projects, including Crolles, France and Agrate, Italy, mentioned in its January 27 call.

Passing on cost increases

As I mentioned with NXP, inflationary cost increases from suppliers are being passed on to customers.

In many cases (Analog Devices, Microchip, NXP), company executives are emphatically stating that they are not trying to take advantage of the situation (think Smithore Gambit) and are only increasing price enough to maintain gross margins.

Others (Diodes Inc, ON Semi) have stated that they intend only to pass on supplier price increases to customers, but it’s not clear whether they are including gross margin in their price increases — in other words, if they sell chips for \$1 each and it costs them 40 cents to make them, but now their cost went up 4 cents (10%) to 44 cents each, will they just pass on the raw cost increase (sell for \$1.04 each) or maintain gross margins (sell for \$1.10 each)?

Infineon and TI have mentioned this idea of “market prices”; here’s Infineon’s Andreas Urschitz on the company’s August 3 call:

We have been historically a bit slower in average to increase prices relative to the one or the other peer. However, we are on track now to very decisively managed to deploy market prices, which allow us to extract a very fair share of the industry profit pools towards our P&L. And when I fair, I mean fair for both, our customers and Infineon. That’s where we stand.

And TI’s Rafael Lizardi on April 26:

On the pricing in general, we are pricing with our customers. Our process on that has not changed. Our process is to price to market. And as prices have moved up over the last two or three quarters, and that certainly did happen in first quarter, we have moved our prices as well, and growth in first quarter did benefit from the pricing tailwind.

Market prices presumably mean they decide on a case by case basis to stay competitive in a general sense....

ST and Renesas have not mentioned any strategy on this topic; Renesas just stated “we are not in the phase of lowering prices” on July 28, and ST has only mentioned the idea of a “favorable pricing” situation in several of their earnings calls.

| Pass on cost increase / price to market | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

Analog Devices | ||||

Diodes Incorporated | ||||

Infineon | ||||

Microchip Technology | ||||

NXP | ||||

onsemi | ||||

Renesas | ||||

ST Microelectronics | ||||

Texas Instruments |

Backlog and inventory

One theme for 2022 is that the backlog — that is, the amount of customer orders that have been placed but not yet fulfilled — is very high (sometimes characterized as “strong”), or increasing.

| Backlog high / increasing | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

Analog Devices | ||||

Diodes Incorporated | ||||

Infineon | ||||

Microchip Technology | ||||

NXP | ||||

onsemi | ||||

Renesas | ||||

ST Microelectronics | ||||

Texas Instruments |

Some of these companies have emphasized that they would like to see more inventory, or that their inventory is increasing but this is a good thing.

| More inventory = good! | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

Analog Devices | ||||

Diodes Incorporated | ||||

Infineon | ||||

Microchip Technology | ||||

NXP | ||||

onsemi | ||||

Renesas | ||||

ST Microelectronics | ||||

Texas Instruments |

Others mentioned an interesting concept, that they prefer in a constrained environment like this to keep inventory outside the “channel”, which is earnings-call-jargon for the distribution channel: that is, instead of sending their manufacturing output to distributors to relieve shortages, they will allocate that output directly to the customers they select.

There’s a potentially unwanted side effect to this strategy: it will probably help larger customers more than small customers, which have to work harder to get the attention and assistance of the semiconductor manufacturers. If Catherine Hepbull from Rooster Novelty Products calls up Kansas Instruments to ask for help getting 5000 microcontrollers to meet production needs for her internet-enabled dog whistle, she’ll probably get sent back to the distributors — whereas if Helen Hornblower, VP at Frob Motor Company, complains to KI that her suppliers are short by 2 million microcontrollers she can’t get to make this year’s Frob Fission and Frob Exploder models, she might have a chance at getting at least some more supply. When revenue talks, suppliers listen.

| Prefer inventory outside channel | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

Analog Devices | ||||

Diodes Incorporated | ||||

Infineon | ||||

Microchip Technology | ||||

NXP | ||||

onsemi | ||||

Renesas | ||||

ST Microelectronics | ||||

Texas Instruments |

Golden Screw

The “golden screw” concept has come up, sometimes directly, sometimes in the guise of “kitting”, which is the process of procuring and gathering parts together for assembly.

| golden screw / kitting issues | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

Analog Devices | ||||

Diodes Incorporated | ||||

Infineon | ||||

Microchip Technology | ||||

NXP | ||||

onsemi | ||||

Renesas | ||||

ST Microelectronics | ||||

Texas Instruments |

In some cases there has even been a vicious cycle, where the semiconductor manufacturers can’t get new equipment as fast as they would like, because the equipment manufacturers can’t get the semiconductors they need. SEMI, one of the semiconductor industry organizations,[16] called this issue the SME (semiconductor manufacturing equipment) multiplier effect.[17]

Alarm over this issue traveled all the way to an article in the Wall Street Journal in early May 2022:[18]

The drought in chip availability that has hit auto production, raised electronics prices and stoked supply-chain worries in capitals around the globe has a new pain point: a lack of chips needed for the machines that make chips, industry executives say.

The wait time it takes to get machinery for chip-making — one of the world’s most complex and delicate kinds of manufacturing — has extended over recent months. Early in the pandemic it took months from placing an order to receiving the equipment. That time frame has stretched to two or three years in some cases, according to chip-making and equipment executives. Deliveries of previously placed orders are also coming in late, executives say.

CEO Ganesh Moorthy mentioned Microchip’s prioritization of these orders to help alleviate the problem in the May 9 earnings call:

And over the last 4, 5 quarters, it’s become more challenging to get equipment in on time. So delays are there. It’s a bit of a vicious cycle. Many of the delays are caused by shortages in semiconductor components. Those in turn, delay the equipment, which delays the ability to solve that problem. We have, in fact, taken the initiative to prioritize supply for many of the semiconductor equipment manufacturers, so that we do our part to both help the industry and help ourselves in doing that, and I believe others are doing it as well. But at the moment, the equipment lead times are getting worse, not better.

| vicious cycle | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

Analog Devices | ||||

Diodes Incorporated | ||||

Infineon | ||||

Microchip Technology | ||||

NXP | ||||

onsemi | ||||

Renesas | ||||

ST Microelectronics | ||||

Texas Instruments |

Cancellation / non-cancelable non-returnable orders

The term NCNR (non-cancelable non-returnable orders) has come up often:

| NCNR | Q1 | Q2 | Q3 | Q4 |

|---|---|---|---|---|

Analog Devices | ||||

Diodes Incorporated | ||||

Infineon | ||||

Microchip Technology | ||||

NXP | ||||

onsemi | ||||

Renesas | ||||

ST Microelectronics | ||||

Texas Instruments |